题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

______out of the taxi, he was seized by the police.A.To stepB.When steppedC.In his steppin

______out of the taxi, he was seized by the police.

A.To step

B.When stepped

C.In his stepping

D.On his stepping

答案

答案

请输入或粘贴题目内容

搜题

请输入或粘贴题目内容

搜题

拍照、语音搜题,请扫码下载APP

拍照、语音搜题,请扫码下载APP

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

______out of the taxi, he was seized by the police.

A.To step

B.When stepped

C.In his stepping

D.On his stepping

答案

答案

更多“______out of the taxi, he was seized by the police.A.To stepB.When steppedC.In his steppin”相关的问题

更多“______out of the taxi, he was seized by the police.A.To stepB.When steppedC.In his steppin”相关的问题

第1题

Which of the following statements is TRUE according to the passage?

A. Some companies in the United States moved to Sweden, Germany and Belgium.

B. Fresh air, spacious room and being away from others attract people to move to the suburbs.

C. People wouldn't pay tax when they moved out of cities.

D. The neighborhood should be maintained by old and poor people.

第2题

Simon then renovated the house at a cost of £50,600, with the renovation being completed on 10 August 2008. He immediately put the house up for sale, and it was sold on 31 August 2008 for £260,000. Legal fees of £2,600 were paid in respect of the sale.

Simon fi nanced the transaction by a bank loan of £150,000 that was taken out on 1 May 2008 at an annual interest rate of 6%. The bank loan was repaid on 31 August 2008.

Simon had no other income or capital gains for the tax year 2008–09 except as indicated above.

Simon has been advised that whether or not he is treated as carrying on a trade will be determined according to the six following ‘badges of trade’:

(1) Subject matter of the transaction.

(2) Length of ownership.

(3) Frequency of similar transactions.

(4) Work done on the property.

(5) Circumstances responsible for the realisation.

(6) Motive.

Required:

(a) Briefl y explain the meaning of each of the six ‘badges of trade’ listed in the question.

Note: You are not expected to quote from decided cases. (3 marks)

(b) Calculate Simon House’s income tax liability and his Class 2 and Class 4 national insurance contributions for the tax year 2008–09, if he is treated as carrying on a trade in respect of the disposal of the freehold house.(8 marks)

(c) Calculate Simon House’s capital gains tax liability for the tax year 2008–09, if he is not treated as carrying on a trade in respect of the disposal of the freehold house. (4 marks)

第3题

Eventually, many downtown areas existed for business only. During the day they would be filled with people working in the offices and at night they would be deserted. Given these circumstances, some business executives began asking, "Why bother with going downtown at all? Why not move the offices to the suburbs go that we can live and work in the same area?" Gradually some of the larger companies began to move out of the cities, with the result that urban centers declined even further and the suburbs expanded still more. This movement of business to the suburbs is not confined to the United States. Businesses have also been moving to the suburbs in Stockholm, Sweden, in Bonn, Germany, and in Brussels, Belgium as well.

What did the city lose when those people moved out to the suburbs?

A.Houses

B.Cars.

C.Jobs.

D.Tax money.

第4题

American Dreams

There is a common response to America among foreign writers:the US is a land of extremes where the best of things qre just as easily found as the worst.This is a cliche(陈词滥调).

In the land of black and white,people should not be too surprised to find some of the biggest gaps between the rich and the poor in the world.But the American Dream offers a way out to everyone.(46) No class system or govemment stands in the way.

Sadly,this old argument is no longer true.Over the past few decades there has been a fundamental shift in the structure of the American economy.

The gap between the rich and the poor has widened and widened.(47)

Over the past 25 years the median US family income has gone up 18 per cent.For the top 1 per cent,however,it has gone up 200 per cent.Twenty-five years ago the top fifth of Americans had an average income 6.7 times that of the bottom fifth.(48)

Inequalities have grown worse in different regions.In California,incomes for lower class families have fallen by 4 per cent since 1969.(49) This has led to an economy hugely in favor of a small group of very rich Americans.The wealthiest 1 per cent of households now control a third of the national wealth.There are now 37 million Americans living in poverty.At 12.7 per cent of the population,it is the highest percentage in the developed world.

Yet the tax burden on America’s rich is falling,not growing.(50) There was an economic theory holding that the rich spending more would benefit everyone as a whole.But clearly that theory has not worked in reality.

A.Nobody is poor in the US.

B.The top 0.01 per cent of households has seen its tax bite fall by a full 25 percentage points since 1980.

C.For upper class families they have risen 41 per cent.

D.Now it is 9.8 times.

E.As it does so,the possibility to cross that gap gets smaller and smaller.

F.All one has to do is to work hard and climb the ladder towards the top.

第5题

Many governments, moreover, are reluctant to wage anti-smoking wars because they're addicted to tobacco taxes. Argentina gets 22. 5 percent of all tax revenue from tobacco; Malawi, 16.7 percent.

Into this climate of naivety and neglect, American tobacco companies have unleashed not only the marketing wizardry (魔术) that most of us take for granted, but other tactics they wouldn't dare use here.

Tobacco spokesmen insist that cigarette advertising draws only people who already smoke. But an ad executive, who worked until recently of the Philip Morris account, speaking on condition of anonymity, disagrees. "You don't have to be a brain surgeon to figure out what's going on. Just look at the ads. It's ludicrous (荒唐的) for them to deny that a cartoon character like Joe Camel isn't attractive to kids."

People in developing countries are easily influenced by cigarette advertising because ______.

A.they don't know the relationship between tobacco and disease

B.they have a strong inclination to smoke

C.they have been forbidden to smoke by the governments

D.there were no institutions which persuade them not to smoke

第6题

It can be inferred from the passage that, before the Progressive Movement, educated women of the middle class were expected to ______.

A.stay out of politics

B.vote on municipal issues only

C.pay a tax in order to vote

D.improve conditions in mills and mines

第7题

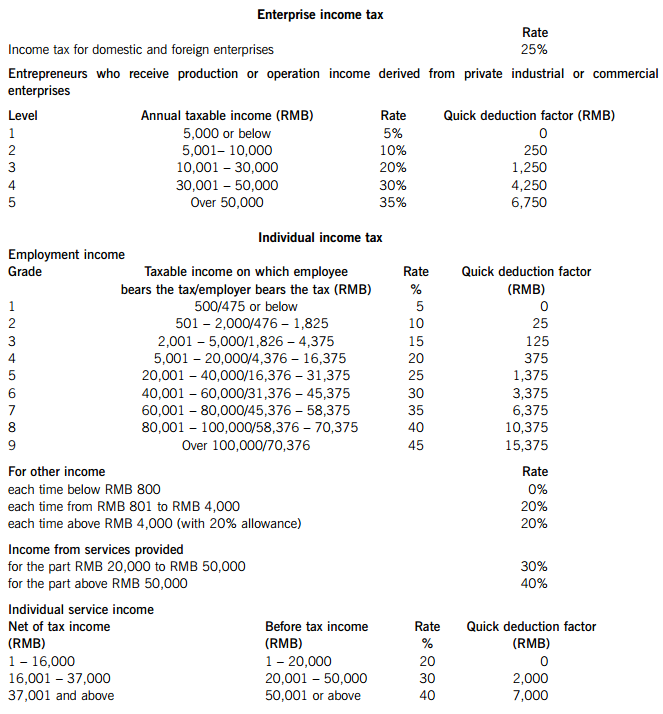

SUPPLEMENTARY INSTRUCTIONS

1. Calculations and workings need only be made to the nearest RMB.

2. Apportionments should be made to the nearest month.

3. All workings should be shown.

TAX RATES AND ALLOWANCES

The following tax rates and allowances are to be used in answering the questions.

1.

(a) The following is the statement of enterprise income tax (EIT) payable prepared by the accountant of Company P for the year 2010:

Notes:

(1) The union has not yet been set up and the expense is a general provision.

(2) The original cost of the fixed asset was RMB 150,000 and the accumulated depreciation was RMB 105,000, while the accumulated tax allowances claimed were RMB 120,000.

(3) The creditor had been liquidated three years ago.

(4) Last year (2009) was the first year a debtors provision was made. A general provision of RMB 500,000 was made but the whole amount was disallowed by the tax bureau. This year the management decided to write back part of provision amounting to RMB 150,000.

Required:

(i) Briefly comment on the correctness of the accountant’s treatment of the 12 items marked with an asterisk (*) in the income tax calculation sheet; (17 marks)

(ii) Calculate the correct amount of enterprise income tax (EIT) payable by Company P for the year 2010. (6 marks)

(b) Briefly explain the term ‘arm’s length principle’ in the context of transactions between associated enterprises pursuant to the enterprise income tax law, together with the adjustment methods that may be used by the tax bureau in cases where this principle is not complied with. (6 marks)

(c) Company C, a limited company with equity of RMB 1,000,000, borrowed two loans from related companies:

– RMB 1,000,000 at a 7% annual interest rate from Company A; and

– RMB 2,000,000 at an 8% annual interest rate from Company B.

The market interest rate for the equivalent loans is a 6% annual interest rate.

In 2010, the interest paid to Company A and Company B was RMB 70,000 and RMB 160,000 respectively. The total amount of interest of RMB 230,000 was allocated RMB 140,000 to interest expense and RMB 90,000 to construction in progress in Company C’s accounts.

Required:

Calculate the amount of interest that will be disallowed for enterprise income tax under each of the account headings: interest expense and construction in progress. (6 marks)

2.

(a) Mr Y, a local Chinese national, a professional writer and artist, had the following income during 2010:

(1) Received income of RMB 45,000 for publishing the first edition of a book, and of RMB 15,000 for the second edition of the same book. The book was also published in a newspaper and he was paid RMB 5,250 for this.

(2) Sold one of his paintings for RMB 5,400.

(3) Gave a speech and was paid RMB 28,500.

(4) Acted as a translator for a movie and was paid RMB 60,000.

(5) Gave a speech in overseas country M and was paid the gross equivalent of RMB 27,000, from which the equivalent of RMB 6,750 in overseas tax was deducted at source.

(6) Sold one of his paintings in overseas country H, and was paid the gross equivalent of RMB 15,000, from which the equivalent of RMB 2,250 in overseas tax was deducted at source.

(7) Received interest of RMB 7,500 on a loan he had made to a domestic enterprise.

Required:

(i) Calculate the individual income tax (IIT) payable by Mr Y in respect of each of the items (1) to (7); (12 marks)

(ii) State how and when any IIT due on Mr Y&39;s overseas income will be reported and paid. (3 marks)

(b)

(i) State when a withholding agent must report and pay the individual income tax (IIT) deducted on a monthly basis from employment income; (1 mark)

(ii) List ANY FOUR situations in which an individual taxpayer needs to do self-reporting for IIT purposes. (4 marks)

3.

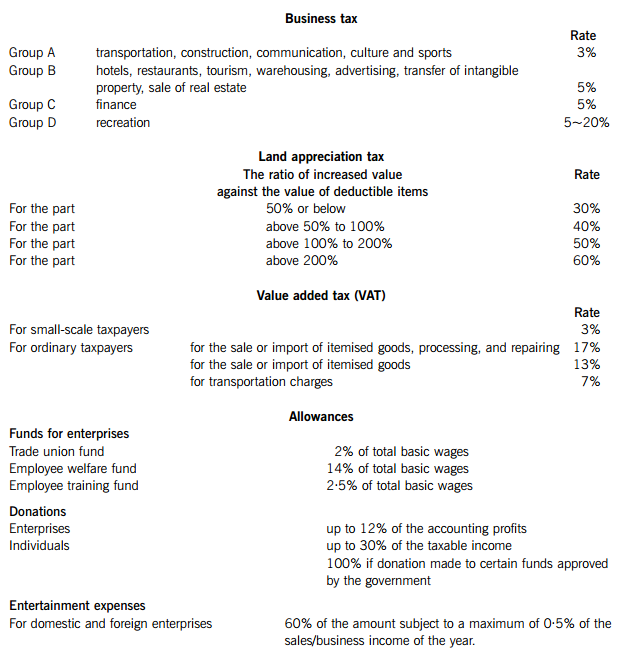

(a) Enterprise G, a general value added tax payer incorporated in Shenzhen for more than 20 years, had the following transactions in the month of May 2010. Some of the enterprises sales are subject to the standard value added tax (VAT) rate, while others are exempt (VAT) activities. All figures are stated including any applicable VAT:

(1) Sold product A (a standard VAT rate item) for RMB 400,000 and product B (a VAT exempt item) for RMB 350,000.

(2) In addition to the sales in (1) above, distributed product A with a market value of RMB 20,000 for staff welfare benefit.

(3) Purchased RMB 500,000 production materials, of which RMB 50,000 was used for a self-constructed building.

(4) Purchased RMB 200,000 agriculture product, of which RMB 20,000 was used for staff welfare benefit.

(5) Purchased a production machine for RMB 100,000 and sold a used machine for RMB 10,000. The used machine had been bought in May 2009 and used by the enterprise ever since then.

Required:

Calculate the value added tax (VAT) payable by Enterprise G for the month of May 2010. (7 marks)

(b) Enterprise H, a small-scale value added tax payer, had the following transactions in the month of May 2010. All figures are stated including VAT:

(1) Sold product for RMB 20,000.

(2) Purchased RMB 500,000 of production materials.

(3) Purchased a production machine for RMB 100,000 and sold a used machine for RMB 10,000. The used machine had been bought in May 2009 and used by the enterprise ever since then.

Required:

Calculate the value added tax (VAT) payable by Enterprise H on each of the above transactions, giving brief explanations of their treatment. (4 marks)

(c) Company X, a property developer, had the following transactions in 2010:

(1) Donated a new building to a high school. The cost of construction of the building was RMB 500,000 and the deemed profit rate is 10%.

(2) Contributed an office building as part of a capital contribution. The cost of the building was RMB 600,000 and the market value RMB 800,000.

(3) Sold an equity holding of unlisted stock for RMB 900,000. The equity holding had been obtained by the contribution of a factory building by Company X which had cost RMB 300,000.

(4) Obtained a six-month bank loan of RMB 2,000,000 from 1 July 2010 with the pledge of a shop owned by the company. During the loan period, the bank did not charge any interest, but instead the bank had the right to use the shop rent free. The market interest rate for a similar loan is 6% per year. At the end of the loan period, Company X sold the shop for a price which gave it RMB 1,000,000 more than the amount needed to repay the bank loan.

Required:

Calculate the business tax (BT) payable by Company X as a result of each of the above transactions (1) to (4), giving brief explanations of their treatment. (6 marks)

(d) State the THREE conditions that must be met for a transportation fee paid by the seller to be excluded from the sale consideration for the purposes of value added tax (VAT). (3 marks)

4.

(a) Company K carried out the following transactions:

(1) Imported a vehicle costing RMB 300,000 and paid transportation costs of USD 10,000 for the journey from the overseas supplier to the port in China.

(2) Shipped a machine with a value of RMB 500,000 overseas for repair and paid for materials of USD 10,000 and a repairing fee of USD 30,000. The machine was shipped back to China in the same month.

(3) Subcontracted some domestic raw materials valued at RMB 200,000 to an overseas company. The related fee and transportation costs were USD 100,000 and USD 20,000 respectively.

(4) Imported raw materials costing RMB 30,000,000 and paid transportation costs of USD 50,000 for the journey from the overseas supplier to the port in China. After the arrival of the materials, Company K discovered that 20% of the materials had a quality problem. The supplier agreed to ship a further 20% replacement materials at no cost to Company K in the same month. Both parties agreed that the quality problem goods should be kept in China.

Required:

Calculate the customs tariff, consumption tax (CT) and value added tax (VAT) payable by Company K as a result of each of the above transactions.

Note: for the purposes of your calculations you should assume that:

(1) The customs tariff for all kinds of imported goods is 20%.

(2) The rate of consumption tax (CT) is 10%.

(3) The USD:RMB exchange rate is 1:6·6

(b) Briefly explain the procedures, including any time limits, for the declaration and payment of the customs

5.

Briefly explain the consequences of the following actions, including any fines or other penalty that may be imposed:

(a) Failure to keep or maintain proper accounting records/vouchers. (2 marks)

(b) Failure to file a return within the prescribed time limit. (2 marks)

(c) Failure to file a return and hence not paying or paying less tax than is duly payable. (1 mark)

(d) Failure to pay tax by concealment of property. (3 marks)

(e) Refusal to pay tax by violence or menace. (2 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

第8题

B.withholding client information

C.being mysterious to the outsiders

D.attracting wealthy foreign clients

According to the passage,the widely-held belief that Switzerland was irresistible to wealthy for-eigners was__________by banks themselves.A.denied

B.criticized

C.reviewed

D.defended

In the last paragraph,the writer thinks that________.A.complete changes had been introduced into Swiss banks

B.Swiss banks could no long keep client information

C.changes in the bank policies had been somewhat superficial

D.more changes need to be considered and made

Swiss banks are tightening its banking rules by________.A.examining the origin of foreign funds before going into accounts

B.preventing doubtful accounts from going into the bank

C.refusal of funds from crimes or tax evasions

D.all of the above

The purpose of the pact signed with the Swiss National Bank was__________.A.to attract more wealthy foreigners to the bank

B.to stop improper use of the banking secrecy laws of the country

C.to increase the numbered accounts of the Swiss Banks

D.to add mystery to Swiss Banks

请帮忙给出每个问题的正确答案和分析,谢谢!

第9题

One of the most comprehensive ventures was the restoration and transformation of Boston's eighteenth century Faneuil Hall and the Quincy Market, designed in 1824. This section had fallen on hard times, but beginning with the construction of a new city hall immediately adjacent, it has returned to life with the intelligent reuse of these fine old buildings under the design leadership of Benjamin Thomson. He has provided a marvelous setting for dining, shopping, professional offices, and simply walking.

Butler Square, in Minneapolis, exemplifies major changes in its complex of offices, commercial space, and public amenities carved out of a massive pile designed in 1906 as a hardware warehouse. The exciting interior timber structure of the building was highlighted by cutting light courts through the interior and adding large skylights.

San Antonio, Texas, offers an object lesson for numerous other cities combating urban decay. Rather than bringing in the bulldozers, San Antonio's leaders rehabilitated existing structures, while simultaneously cleaning up the San Antonio River, which menders through the business district.

What is the main idea of the passage?

A.During the 1970's, old buildings in many cities were recycled for modern use.

B.Recent interest in ecology issues has led to the cleaning up of many rivers.

C.The San Antoino example shows that bulldozers are not the way to fight urban decay.

D.Strong government support has made adaptive rehabilitation a reality in Boston.